From O’Shaughnessy’s 2005: The Oregon House of Representatives voted May 30 to allocate $900,000 from the marijuana program’s $1.1 million surplus to meet unrelated Department of Human Services expenses. The marijuana program was created by a voter initiative in 1998. Since then, more than 10,400 patients have paid fees to register and renew. The fee was $150 when the program began but has been lowered as the surplus accrued. Today the fee is $55 ($20 for members of the Oregon Health Plan). It could have been reduced further if the legislators didn’t decide to dip into the cannibucks for other purposes.

The Cost of Prohibition Calculated

How long can government refrain from taxing instead of prohibiting the marijuana industry? There would be annual savings of $7.7 billion and tax revenues of $6.2 billion if marijuana were legalized, according to a report issued last week by Jeffrey Miron, a Visiting Professor of Economics at Harvard.

Underwritten by the Marijuana Policy Project, the report projects savings of $5.3 billion now spent by state and local governments —±police arresting, courts prosecuting, and jails and prisons incarcerating people for selling marijuana. The federal government would save $2.4 billion by calling off its marijuana interdiction efforts, according to Miron.

In estimating potential tax revenue, Miron uses the Drug Czar’s figure of $10.5 billion spent by U.S. residents on marijuana in 2000. His assumption that legalization would not increase demand probably “biases the estimated tax revenue downward,” he notes.

He foresees two offsetting effects on supply. On the one hand, production might rise because “marijuana suppliers in a legal market would not incur the costs imposed by prohibition, such as the threat of arrest, incarceration, fines, asset seizure, and the like… On the other hand, marijuana suppliers in a legal market would bear the costs of tax and regulatory policies that apply to legal goods but that black market suppliers normally avoid.”

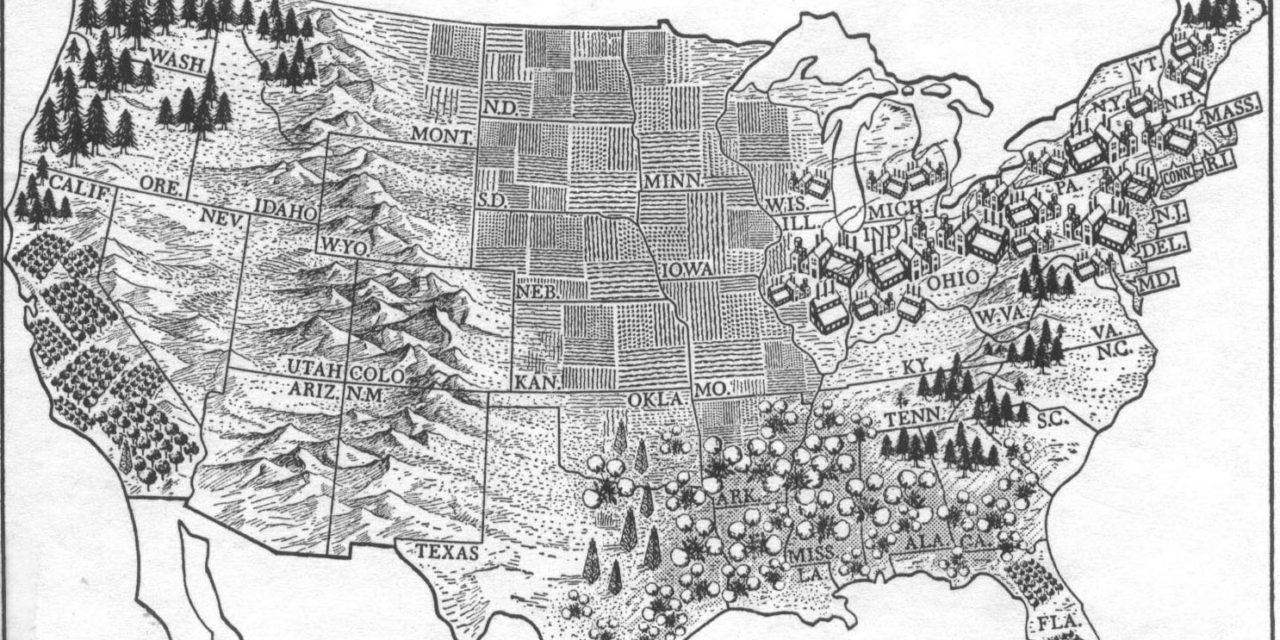

The report considers a range of taxing options, from treating marijuana like an ordinary commodity (which would generate $2.4 billion annually) to a high “sin tax” equivalent to 80% of the price (would raise $9.5 billion). Miron settles on a rate akin to the tax on alcohol and tobacco that would raise the price 50% and produce revenue of $6.2 billion per year. One of the tables shows how much each state stands to generate.

The Miron report can be viewed at http://www.prohibitioncosts.org/mironreport.html.

It states the obvious and is rife with dubious assumptions and false rigor, but it serves a purpose -to advance the political discussion. Its release by MPP June 2, along with its endorsement by 500 economists, resulted in a small spate of articles and op-eds.

Milton Friedman reiterated his principled position: “$7.7 billion is a lot of money, but that is one of the lesser evils. Our failure to successfully enforce these laws is responsible for the deaths of thousands of people in Colombia. I haven’t even included the harm to young people. It’s absolutely disgraceful to think of picking up a 22-year-old for smoking pot. More disgraceful is the denial of marijuana for medical purposes.”

On the Forbes website, Quentin Hardy extrapolated from a couple of sentences in Miron’s report to the possible impact of legalization on the private sector. “If the laws change, large beneficiaries might include large agricultural groups like Archer Daniels Midland and ConAgra Foods as potential growers or distributors and liquor businesses like Constellation Brands and Allied Domecq, which understand the distribution of intoxicants. Surprisingly, Home Depot and other home gardening centers would not particularly benefit, according to the report, which projects that few people would grow their own marijuana, the same way few people distill whiskey at home.”

The Marijuana Policy Project is spinning the Miron report to appeal to the war-on-terrorized. The MPP press release says, “Just one year’s savings would cover the full cost of anti-terrorism port security measures required by the Maritime Transportation Security Act of 2002. The Coast Guard has estimated these costs, covering 3,150 port facilities and 9,200 vessels, at $7.3 billion total.” And we can take whatever money’s left in the Oregon marijuana program and send it straight to Haliburton for pipeline protection in Iraq… Nobody more patriotic than us potheads!