July 10, 2021 By Fred Gardner

In 2020-21, as a result of Covid-19 restrictions, San Francisco is expected to make $99 million less than its budget calls for from the business tax; $43.4 million less from the hotel tax; $17.8 million from the parking tax. The city —like many others in the US— looks to cannabis for financial salvation. As explained to the SF Chronicle by a cannabis industry spokesman at the height of the pandemic:

“‘People have more time to smoke and more time to consume,’ said Johnny Delaplane, president of the San Francisco Cannabis Retailers Alliance. “Cannabis can also help with anxiety and with people who have trouble sleeping.”

“Delaplane chalked up part of the increased pot sale projections to more people buying and more dispensaries opening in the last year. It also helped that cannabis dispensaries were classified as ‘essential businesses,’ like grocery and hardware stores, and allowed to stay open during the darkest days of the shutdown. But even though they are essential businesses, Delaplane said, the pandemic has been tough on dispensaries located downtown and South of Market, where offices sit empty as workers telecommute from home. But in the neighborhoods, cannabis businesses appeared to do fine.

“’If you pass by a cannabis shop on your way to getting a cup of coffee, then there is a better chance that you are going to stop in,’ Delaplane said.”

What Taxing Cannabis Signifies

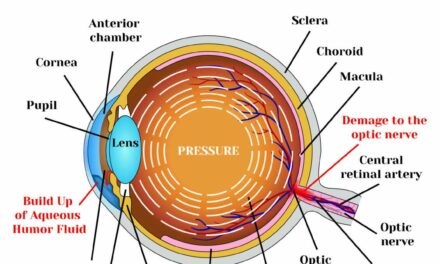

Only one state, Illinois, taxes prescription drugs —and the rate is 1%. Over-the-counter drugs are subject to state sales tax in all but nine states. Thus the 15% excise tax that medical cannabis users must pay under California’s legalization scheme is a denial that cannabis is medicine.

The medical marijuana movement had made cannabis safe for capital by 2016 in California, and capital —”the industry”— returned the favor by wiping out the movement. Some members of the Society of Cannabis Clinicians left the field in the years that followed legalization. Others saw their patient base dwindle and/or converted their practices to telemedicine. Nobody is organizing the pot-loving masses or lobbying the money-loving legislators to oppose the 15% tax on medical cannabis. The SCC is the group most likely to take up the patients’ cause.

SCC founder Tod Mikuriya, MD, had filed an amicus brief in the case of People v. Myron Mower, which

was decided by the California Supreme Court in August 2002 and put physician-approved cannabis users on a legal part with prescription drug users. Here’s the background:

In April ’98, in Tuolomne County Superior Court, Myron Mower —a severe diabetic, legally blind— was tried and convicted of felony cultivation. Sheriff’ s deputies, after raiding his house and ripping out 28 of 31 plants (Tuolomne having decided on a three-plant limit), had found Mower in a hospital, hooked up to a morphine drip, unable to hold down food. “My health was all in that garden,” Mower told them. “You guys don’t know what you’ve done to me.” Without a lawyer, Mower “confessed” that the plants were for himself and two other sick people —resulting in his conviction and the imposition of a $1,000 fine, plus five years’ probation.

At Mower’s trial the prosecution only had to show by a preponderance of the evidence that his medical-use claim was false. This standard made California patients accused of marijuana violations less than equal under the law, because all other comparable crimes in which a defendant pleads “not guilty” must be proved beyond a reasonable doubt. Mower’s appeal was handled by Gerald Uelmen, the prestigious former dean of the University of Santa Clara School of Law. Dr. Mikuriya and patient advocate Pebbles Trippet filed an amicus brief in Mower’s support.

The state Supreme Court reversed Mower’s conviction on the grounds that the trial court had incorrectly instructed the jury on the burden-of-proof question. The Mower ruling entitled defendants who claimed “medical use” to file a motion to have charges dismissed at a preliminary hearing prior to trial; and if the case proceeds to trial, the burden of proof beyond a reasonable doubt is on the government.

Chief Justice Ronald George wrote, “The possession and cultivation of marijuana is no more criminal —so long as its conditions are satisfied— than the possession and acquisition of any prescription drug with a physician’ s prescription.” He added, “Had the jury properly been instructed that defendant was required merely to raise a reasonable doubt about his purposes instead of proving such purposes by a preponderance of the evidence… the jury might have entertained a reasonable doubt in defendant’ s favor.”

This prosecutorial advantage for conviction had prevailed for six years after California voters legalized the medical use of cannabis. It was created by CALJIC, an advisory board of judges based in Los Angeles, which issues “standard jury instructions” for criminal trials. The preponderance standard was then adopted by judges in a majority of trials involving medical cannabis users. As a result, hundreds of patient-defendants were convicted at trial or accepted plea bargains to avoid trials that would not have occurred if prosecutors had to prove a patient’s guilt beyond a reasonable doubt.

It took the California Supreme Court to end the unfair double standard. Chief Justice Ronald George, a political moderate, wrote an opinion declaring that medical cannabis use is “no more criminal than” prescription drug use. Pebbles Trippet commented, “The perfect remedy for discrimination is equality.”

As a non-profit organization, the SCC can’t lobby for specific legislation exempting medical cannabis users from paying a 15% excise tax; but the can publicize the plight of patients who now must choose between affording their medicine (at a legal dispensary) and seeing a specialist to develop a treatment plan.

The legislator who drafted California complex legalization scheme in 2016, Rob Bonta, has now been named Attorney General. By 2019, realizing that high taxes were driving consumers to obtain cannabis from unlicensed sources, Bonta began calling for a reduction in the excise tax for all Californians to 11%. (In 2021 he was named state Attorney General.) An 11% excise tax is a step in the right direction for all users, but ignores the reality that for medical users, given the Mower precedent, the tax rate should be nil.

Zero is obviously too much to ask of revenue-hungry legislators, many of whom only abandoned their prohibitionist positions because there was tax money to be had. A more realistic demand would be: tax medical cannabis as an over-the-counter medicine. (The tax rate for OTC drugs in California is 7.25%.)

If the legislators recognize that cannabis is being used as medicine, they should tax it as a medicine. Period.